For those of you who are beginners, you may not know what the order book is and how the market limit differs from the instant market. Let’s find out in this article.

Beginners are usually confused about how to buy Bitcoin and altcoins. Usually, after registering, you are still confused about what crypto to buy.

In this article, we will explain what an order book is, and what’s the difference between buying with the limit method and the instant method.

What is Order book?

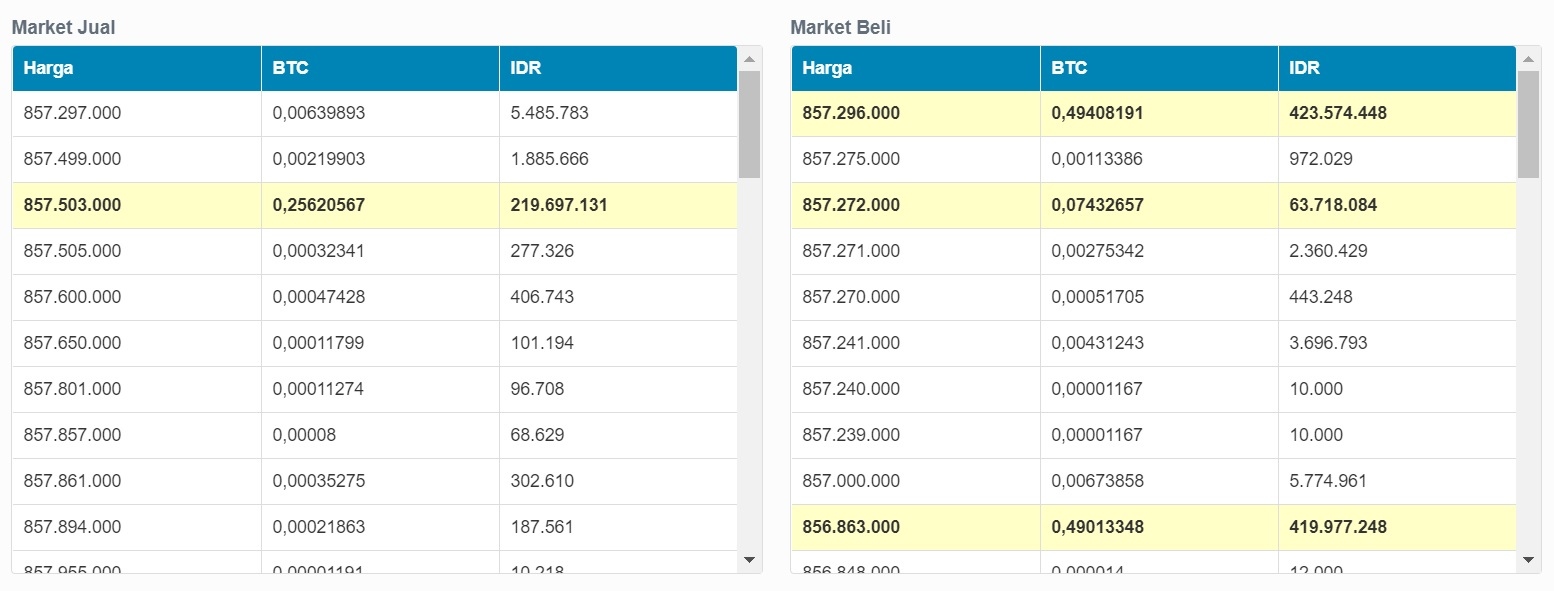

Order Book is a list of selling prices and buying prices available in the market today. You can buy or sell Bitcoin and altcoins using the prices listed there.

So, the order book is a display of transactions listed on a crypto market. For example in Bitcoin, Ethereum and others. The order book is also a record of transactions that occur during a certain time.

Each crypto market has a different order book. Because indeed the transactions are different.

The order book is separated into two, namely a purchase record and a sales record (but and sell). Usually, simple technical analysis can use the order book.

If the buy transaction record is greater than the sale (sell), the crypto will immediately go up. And vice versa.

To make it easier for you, the Indodax market divides the Order Book into two parts, namely:

Market Limit

1. Buy

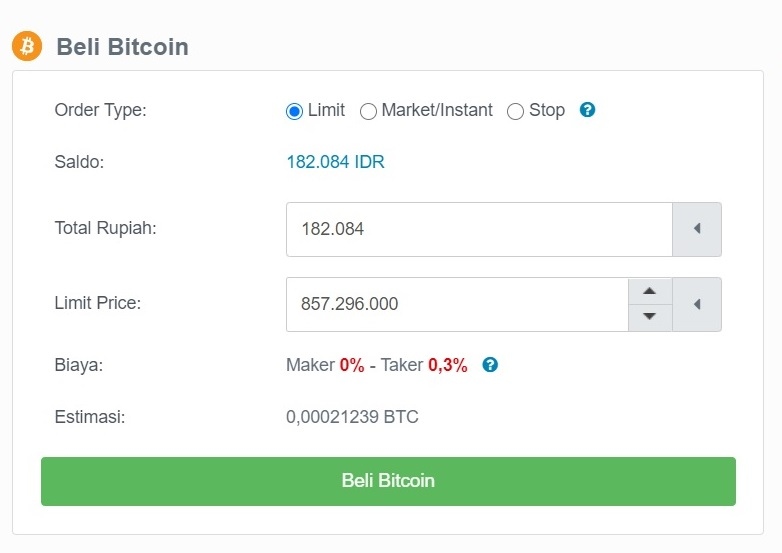

Limit is the process of buying or selling digital assets at a price that you set yourself. If you use the limit method, the buying and selling process is free.

For example, with IDR 100,000, you want to buy Bitcoin at IDR 850 million, even though at that time the Bitcoin price was IDR 870 million.

Later, if the Bitcoin price has dropped to Rp.850 million according to your order, the Bitcoin will be bought and your balance will rotate.

The limit method is used to make purchases automatically at a lower price.

2. Sales

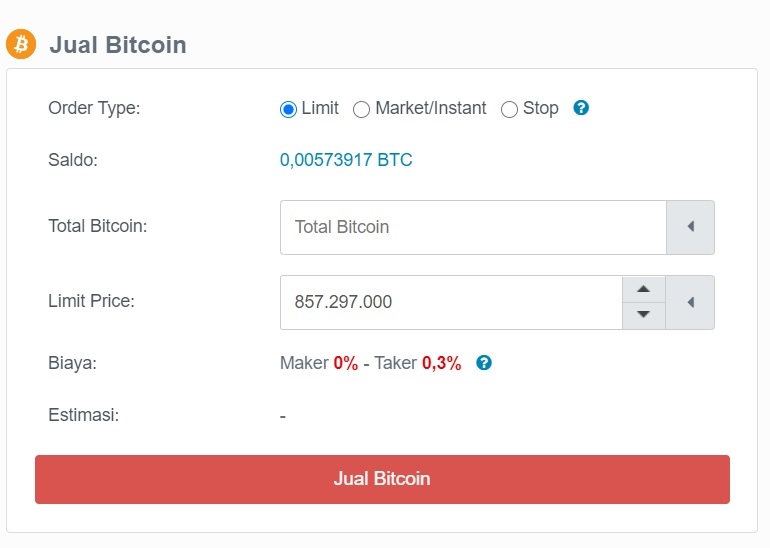

You can also use the limit method when you sell it after you have Bitcoin or any altcoin. So, you can determine from the start at what price you want to sell crypto.

For example, after you buy Rp.850 million in Bitcoin, you can place a limit order for sale by entering a price of Rp. 900 million.

Later, after the price hits IDR 900 million, your Bitcoin or asset will be sold. Your balance will automatically increase.

This method is used to make a profit when crypto prices are high and in a fast time. You don’t need to log in and sell it manually because it’s already sold automatically.

Just like when buying, selling using the limit method is also not subject to any fees or fees.

Market Instant

1. Buy

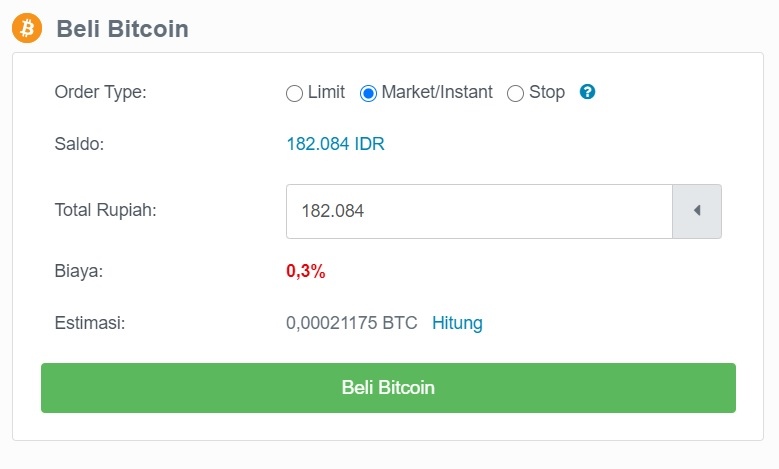

Instant market is a transaction with the best price in the order book. You can use this method to get your crypto spinning fast.

Usually, this method is used for traders or investors who want to immediately own crypto.

Because it is different from the limit method which takes time until the crypto price is right or until someone buys it. Meanwhile, instant market purchases are made directly without waiting.

The order book will find the best price for those of you who use the instant market method. It’s just that, instant market is subject to a fee or transaction fee of 0.3%.

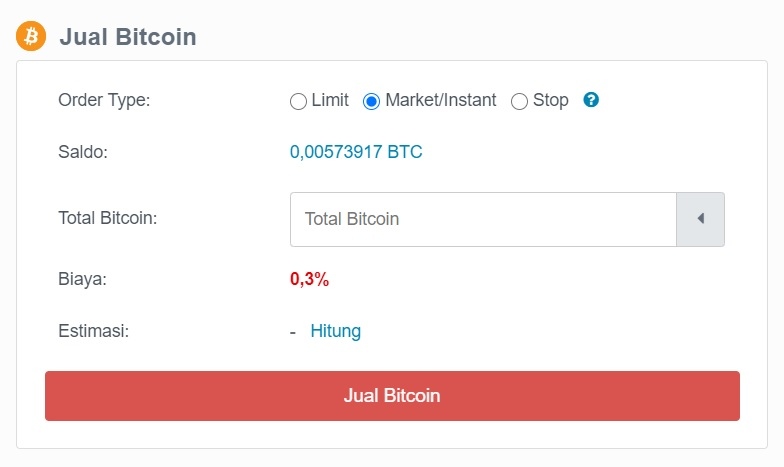

2. Sales

Likewise, when buying using the instant market, sales also find the best price from the order book.

Usually this method is used for those who want to get immediate profit or who want to cut losses. Unlike the limit method, which has to wait a long time, instant sales sell your crypto right away.

Similar to buying, the limit method when selling crypto is also subject to a fee or fee of 0.3%.

Conclusion: Don’t Get Wrong

Usually, a novice trader often presses the wrong button. Because they can’t tell which ones are selling, which ones are buying. Apart from that, it is also impossible to tell the difference between limit and instant.

For that, you need to understand it in order to get consistent benefits.

Stay tuned for indodax.academy articles and videos. Don’t miss other interesting information on Indodax’s official social media.