This week’s Indodax Market Signal analyzed that Ethereum has entered a bullish signal. However, this is not the case with Bitcoin.

Why is that? In fact, the price of Bitcoin is almost similar to the price of Ethereum. Although Bitcoin and Ethereum prices are similar, they are not always exactly the same.

Bitcoin still hasn’t shown any price strengthening over the next week. Even though it has strengthened over the past week, Bitcoin will still show a reasonable price decline.

However, Bitcoin is still allegedly going to increase in price in the long term.

Then, why did Ethereum actually increase? What crypto assets are going up and what are going down?

Before we discuss further about Indodax Market Signal in this edition, we would like to remind you that trading on Indodax has no more withdrawal fees starting on August 2, 2021 for all members without conditions.

5 Crypto Assets will Bullish This Week

- Ethereum (ETH)

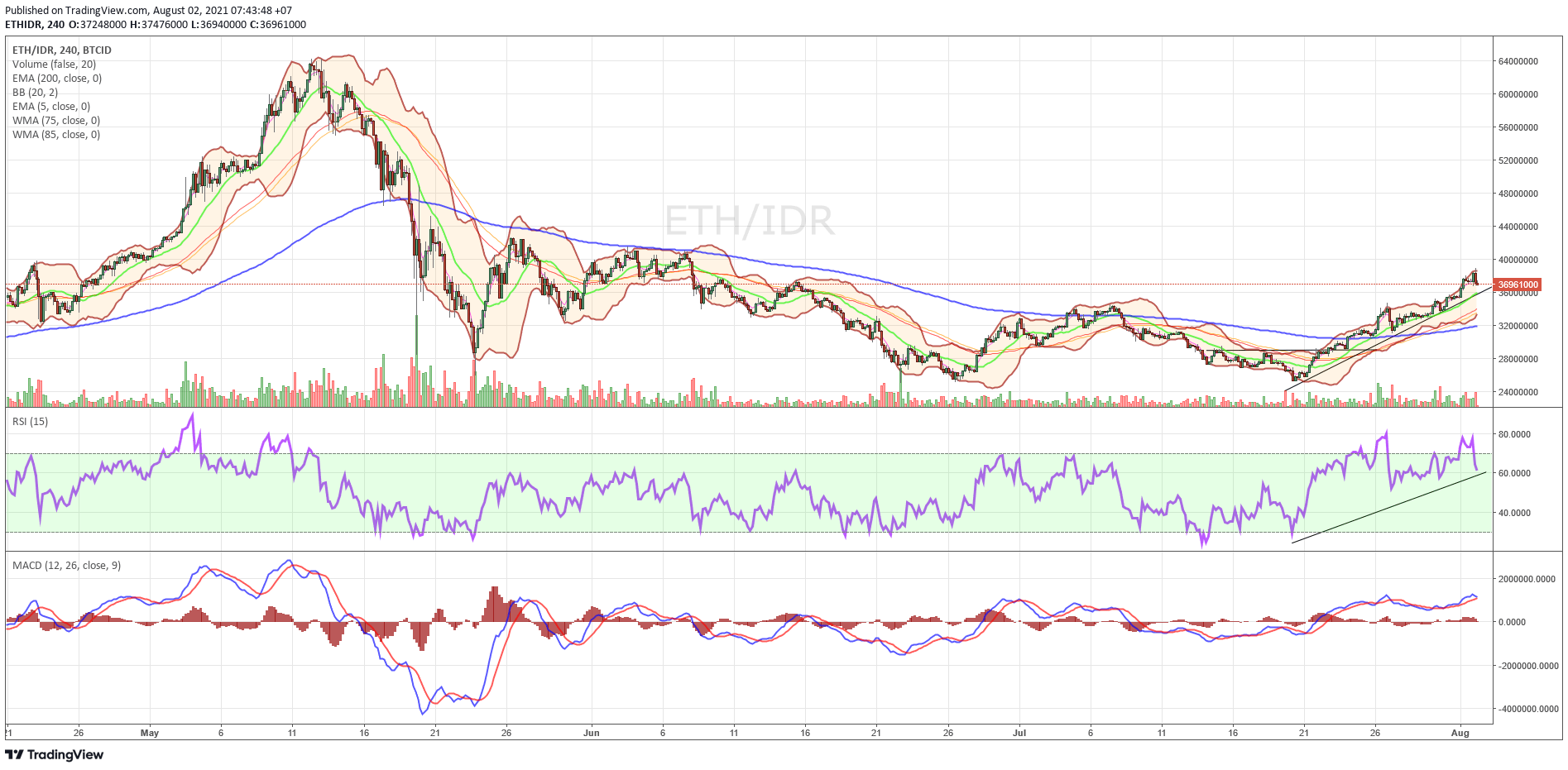

For the first time since the market crash or fall since last May, Ethereum has entered a bullish market. Indodax Market Signal analyzes that ETH indicates an upward signal for the next week.

This is because Ethereum will run the London Hard Fork or EIP-1559 where the Ethereum upgrade will be burned or destroyed in a small part. It will start on August 4, 2021.

The Ethereum EIP-1559 proposal aims to reduce so that the network is more vacant and make the network more efficient. In addition, the scarcity factor also causes prices to increase.

The lowest price of ETH today is IDR 36.800.000 and the highest price is IDR 38.950.000.

.

Chart ETH/IDR

- Polkadot (DOT)

Indodax market signal also gives a signal that Polkadot (DOT) will increase for one week. This is because Polkadot is being flooded with requests.

Polkadot is a blockchain project that has the function to combine several blockchain networks so that the system runs optimally. It is also commonly referred to as a parachain.

The lowest price of DOT today is Rp256,428 and the highest price is Rp288,779.

Chart DOT/IDR

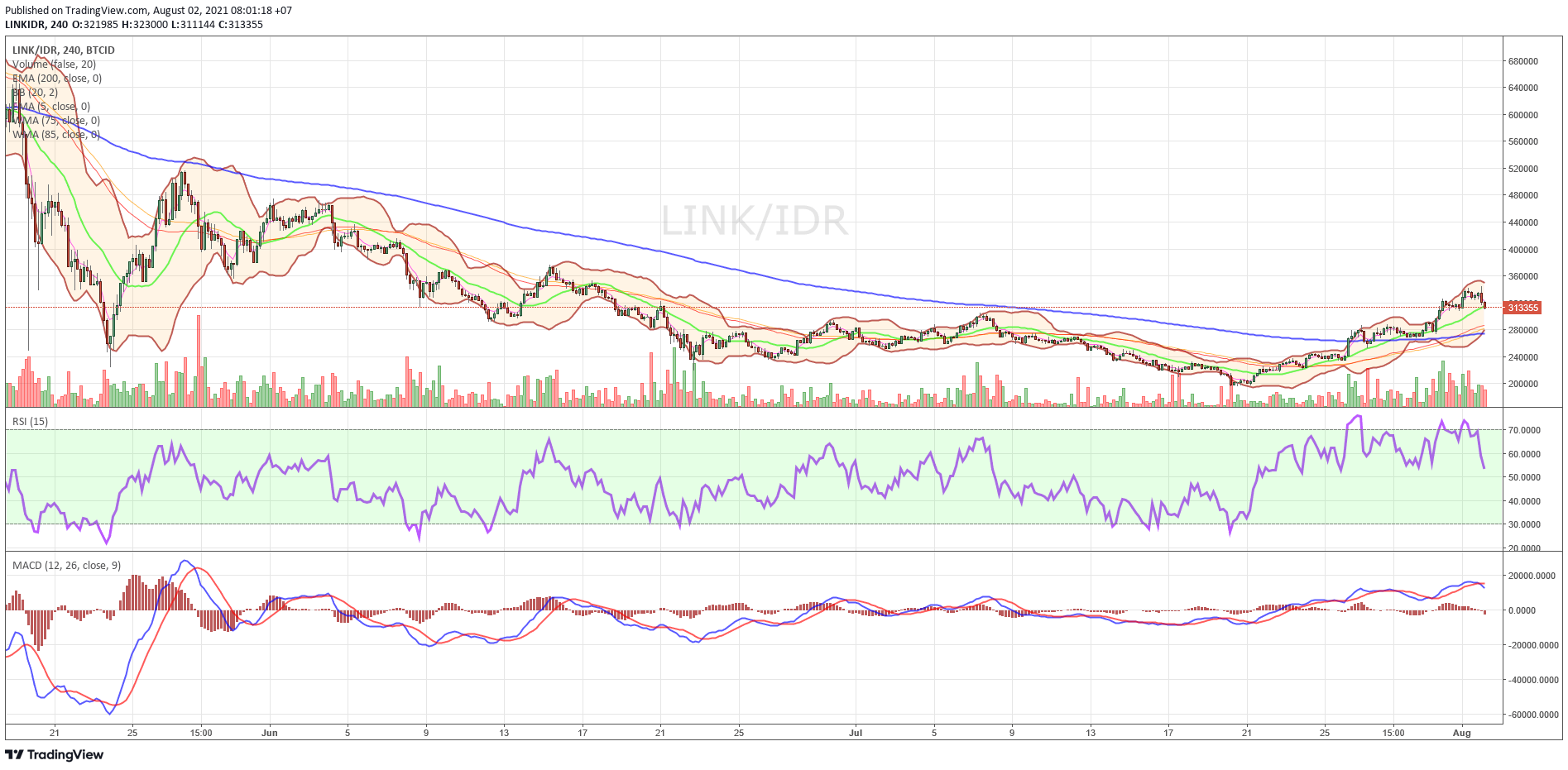

Third, there is the DeFi Chainlink crypto asset. This crypto asset is also experiencing a flood of demand, so it is likely to be up for a week.

Chainlink is developing secure blockchain middleware that intends to link smart contracts across the blockchain by allowing smart contracts to access off-chain resources such as data feeds, web APIs, and traditional bank account payments.

On this day, the lowest price for LINK is Rp.311.114 and the highest is Rp.345.000.

Chart LINK/IDR

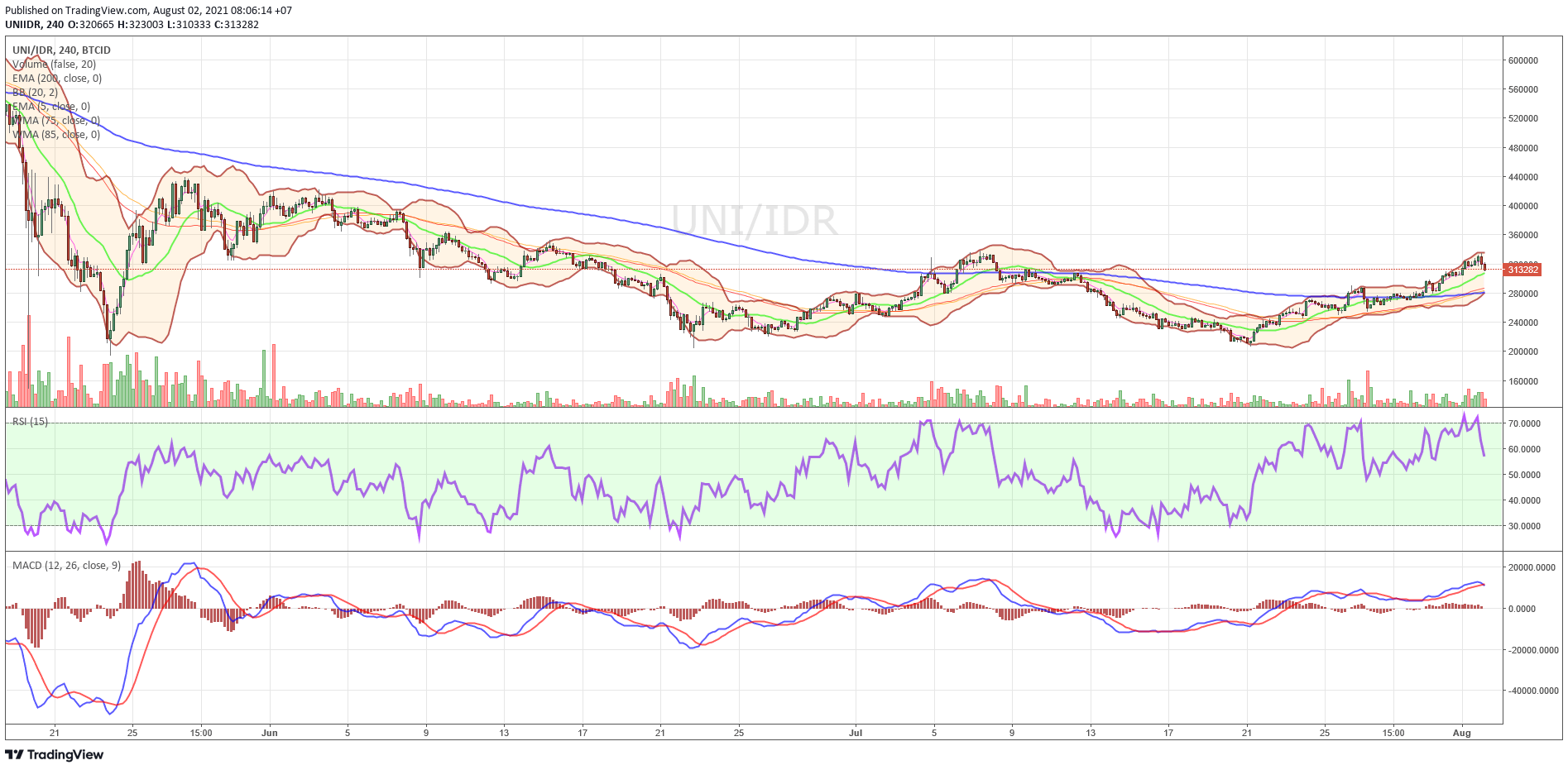

Then, there is the Uniswap (UNI) crypto asset which will also rise this week. Apparently, there is an increase in demand from the two most popular DeFi crypto assets, namely LINK and UNI.

Uniswap is one of the DEXs that is much loved by crypto asset activists, especially people who are interested in Decentralized Finance (DeFi). This blockchain project exists on top of the ERC-20 network.

It comes with cutting-edge solutions and technologies built into DeFi. UNI tokens are tokens that reside on the network.

On this day, UNI’s lowest price was IDR 310,333 and its highest price was IDR 334,999.

Chart UNI/IDR

- Neo (NEO)

Finally, at Indodax Market Signal there is a NEO crypto asset that will rise this week.

NEO as China’s first original and open source public chain project serves as a smart asset platform. Smart assets are a combination of blockchain smart contracts and digital assets. NEO enables a smarter way for asset registration, issuance and circulation.

In today’s trading, the lowest price for NEO was Rp602,500 and the highest was Rp661,500.

Chart NEO/IDR

5 Crypto Assets will Bearish on This Week

- Aurora (AOA)

Indodax Market signal also discusses crypto assets that will be bearish. First, there is Aurora (AOA) which will drop over the next week. This also continues the downward trend in its price since a few weeks ago.

There doesn’t seem to be any upgrades yet and the demand is actually decreasing which causes the price to drop. AOA has shown a downward trend in prices since a few weeks ago and remains in a bear market.

Aurora Chain (AOA) is on a mission to create a brightly colored blockchain world with fast-paced contracts that facilitate easy application development on the blockchain.

Today, the price of AOA Today, the price of AOA is at the lowest level of Rp. 18 and the highest price of Rp. 20.is at the lowest level of Rp. 18 and the highest price of Rp. 20.

Chart AOA/IDR

- Algorand (ALGO)

Algorand (ALGO) is the second crypto asset to appear bearish over the next week. Apparently, this crypto asset was abandoned by its traders.

Algo enters the ecosystem through a variety of channels including development and research grants, rewards to participants, and communities. All of these activities are disclosed with full transparency to the Algorand community.

The Algorand blockchain network has its own official native cryptocurrency, called ALGO.

ALGO’s lowest price is Rp11,700 today. While the highest price is Rp. 12,620.

Chart ALGO/IDR

- Vidy X (VIDYX)

Next, there is the VIDY X crypto asset which experienced a decline in price this week. Apparently, investors will have to move to other crypto assets and leave VIDYX so that demand drops.

The Vidy project was started by Harvard Scholar Patrick Colangelo and former Credit Suisse Investment Banker, Matthew Lim. Together, they built a formidable engineering and business development team. Patrick leads all technology and product development in New York while Matthew runs all business development in Asia.

Today, VIDYX is moving at the lowest level of IDR 3,300 and the highest price of IDR 3,851.

Chart VIDYX/IDR

- GXChain (GXC)

Next is a local crypto asset, GXChain (GXC) which will drop this week. Apparently, this crypto asset still hasn’t strengthened in a week’s time.

GXChain is the fundamental blockchain for the global economy, designed to create trusted value on the Internet.

Leveraging the Graphene architecture based on Dpos, GXChain has functions such as G-ID, GVM, BaaS, and Blockcity, which help simplify application development.

Today, GXC moved with the lowest price of IDR 6,700 and the highest price of IDR 7,289.

Chart GXC/IDR

- Vexanium (VEX)

Finally, the crypto asset that has experienced a decline is Vexanium (VEX). The decline is also suspected to have occurred during this week, continuing the decline from two weeks ago.

Vexanium will be a platform to support new blockchain companies in developing their smart contracts and decentralized applications (DApps).

As the first public blockchain in Indonesia, Vexanium is building the next generation blockchain for mass adoption, born to support the usability and penetration of DApps (Decentralized Applications). Vexanium will make blockchain technology accessible and used to power various industries

Chart VEX/IDR

NOTE: If the 5 EMA crosses the WMA 75, 85 and 200 EMA lines and the lines intersect from the bottom up, then the market trend tends to go up (bullish),

in each table above shows if, the value of EMA 5 is higher than WMA 75.85 and EMA 200 then the market tends to go up (bullish).

If the RSI and MACD values ??show the same condition, it means the market is showing the same trend, overbought (overbought) or oversold (oversold) conditions are an indicator that the market is already at the point of changing the direction of the trend.

ATTENTION: All content which includes text, analysis, predictions, images in the form of graphics and charts, as well as news published on this website, is only used as trading information, and is not a recommendation or suggestion to take an action in a transaction, either buying or selling. certain crypto assets. All crypto asset trading decisions are independent decisions by the user. Therefore, all risks arising from it, both profit and loss, are not the responsibility of Indodax.