Bitcoin was still down last week. This week, it’s the same. How about other crypto assets? Let’s take a look at Indodax Market Signal on May 24, which will review prices for this week.

Indodax Market Signal May 24th, 2021, still displays 5 crypto assets that experienced price increases (bullish) and price declines (bearish). Market conditions this week seem almost the same as last week.

Bitcoin has experienced a decline this week continuing the downward trend last week and before. Bitcoin’s decline is due to negative news in China and Elon Musk.

However, Bitcoin’s decline is not the end. Because there are still crypto assets that will rise this week. What are these crypto-assets?

Let’s take a look at the bullish and bearish crypto assets on Indodax Market Signal on May 24, 2021.

5 Crypto Assets will Bullish

- Tether (USDT)

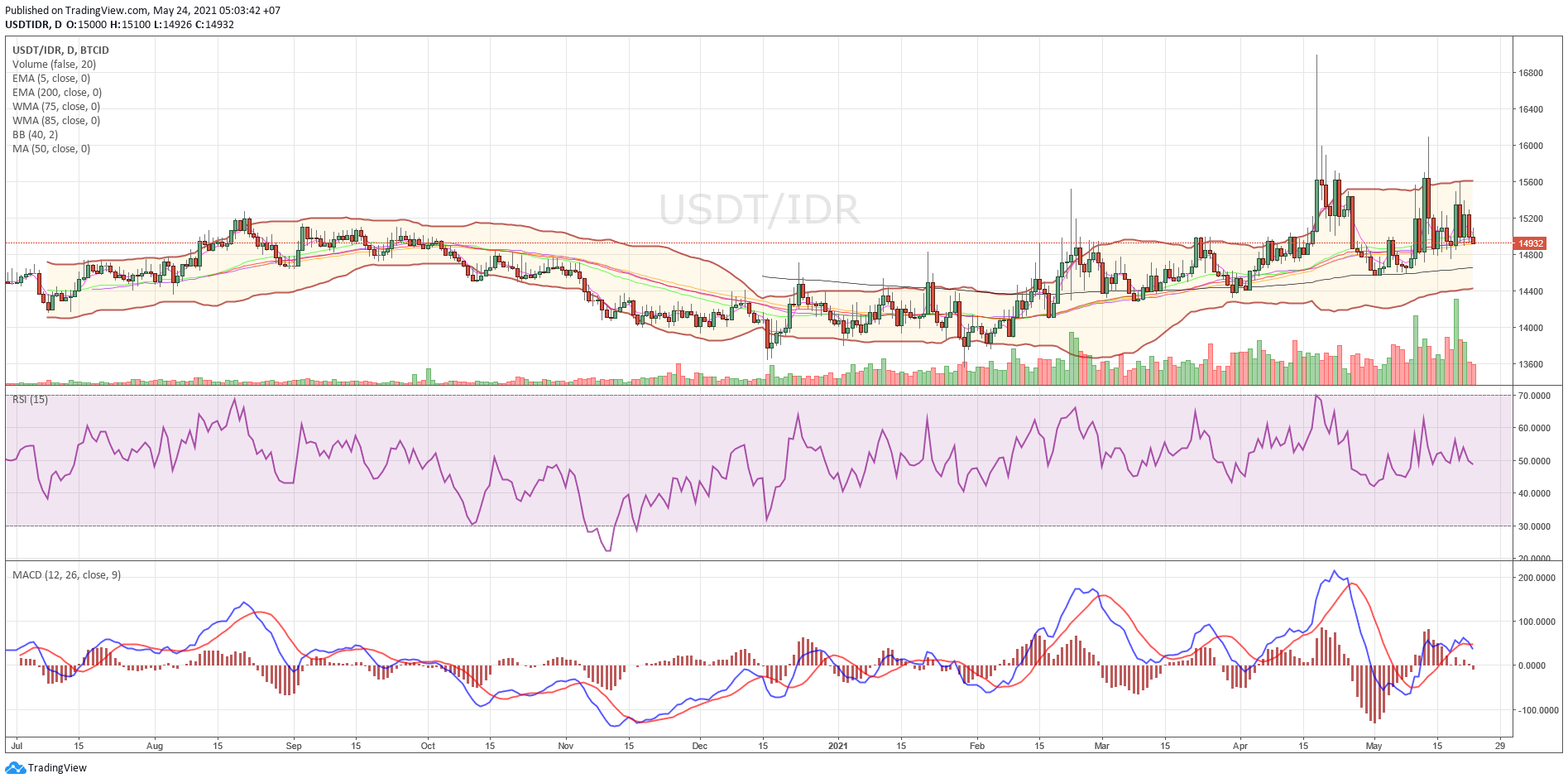

Indodax Market Signal May 24, predicts Tether (USDT) prices will strengthen this week. This is due to the high demand for USDT and the weakening of the Rupiah currency.

USDT is a crypto asset that is 1: 1 in comparison to USD. USDT supply or supply is also the same as USD dollar supply. Tether provides protection from cryptocurrency volatility. Tether allows businesses to easily deploy fiat-powered tokens on the blockchain.

Today’s lowest price for USDT is IDR 14,926 and the highest price is IDR 15,100.

Chart USDT/IDR

- USD Coin (USDC)

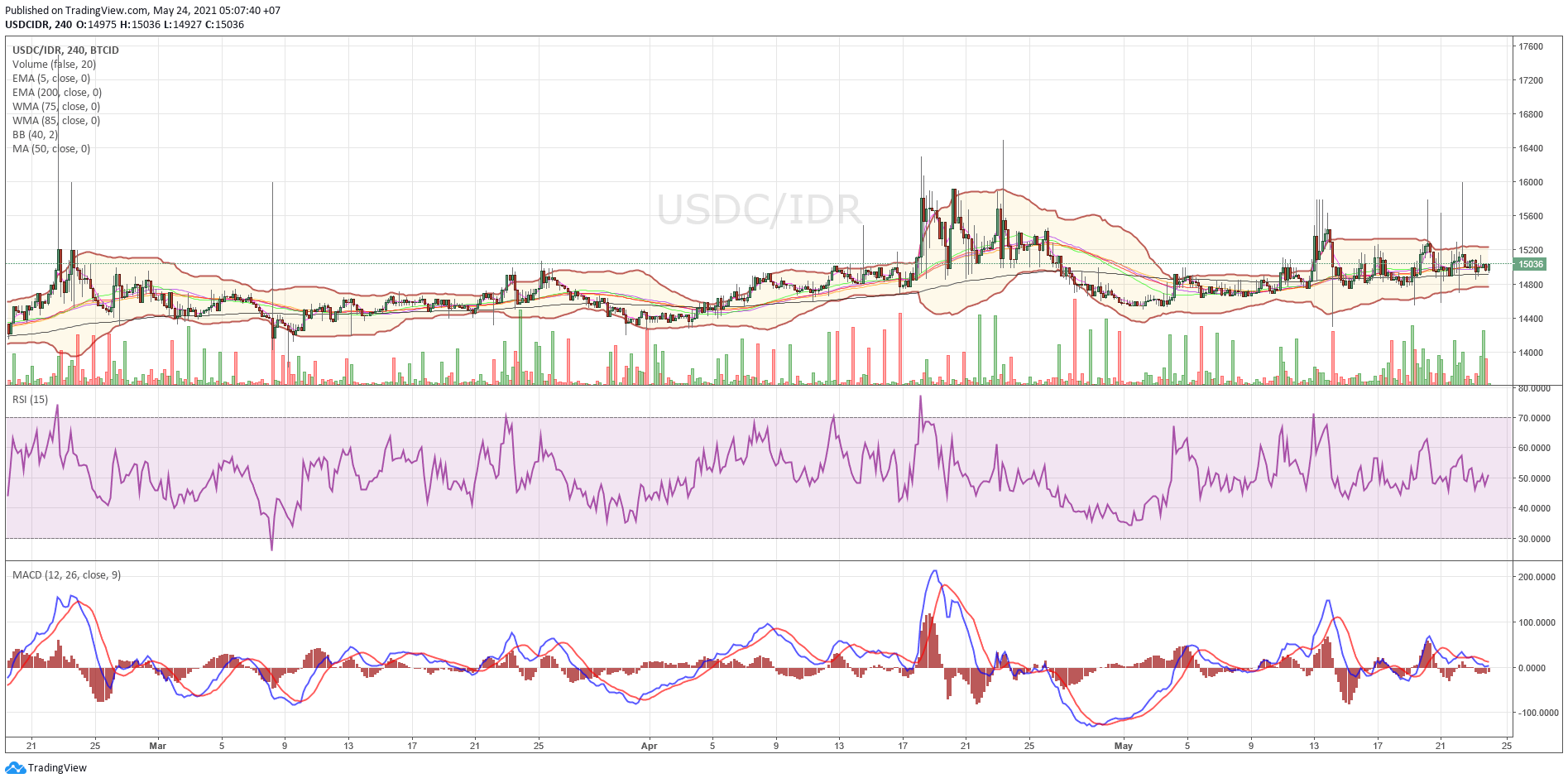

Next, the crypto asset that has experienced an increase in price is still from USD stablecoin, namely USD Coin (USDC). The reason why the USDC price strengthened this week is still the same as USDT, even though the ping pong price is because both of them are stablecoins of fiat currencies.

USDC is managed by CENTER (Consortium of a joint venture company between coinbase & Circle) which acts as a regulatory body, which oversees fiat reserves and ensures regulatory compliance of USDC issuers.

The CENTER consortium model allows industry leaders to work together to define open standards for building a global financial system on crypto rail and blockchain infrastructure.

On this day, the lowest price for USDC is IDR14,851 and the highest is IDR15,150.

Chart USDC/IDR

- Theta Fuel (TFUEL)

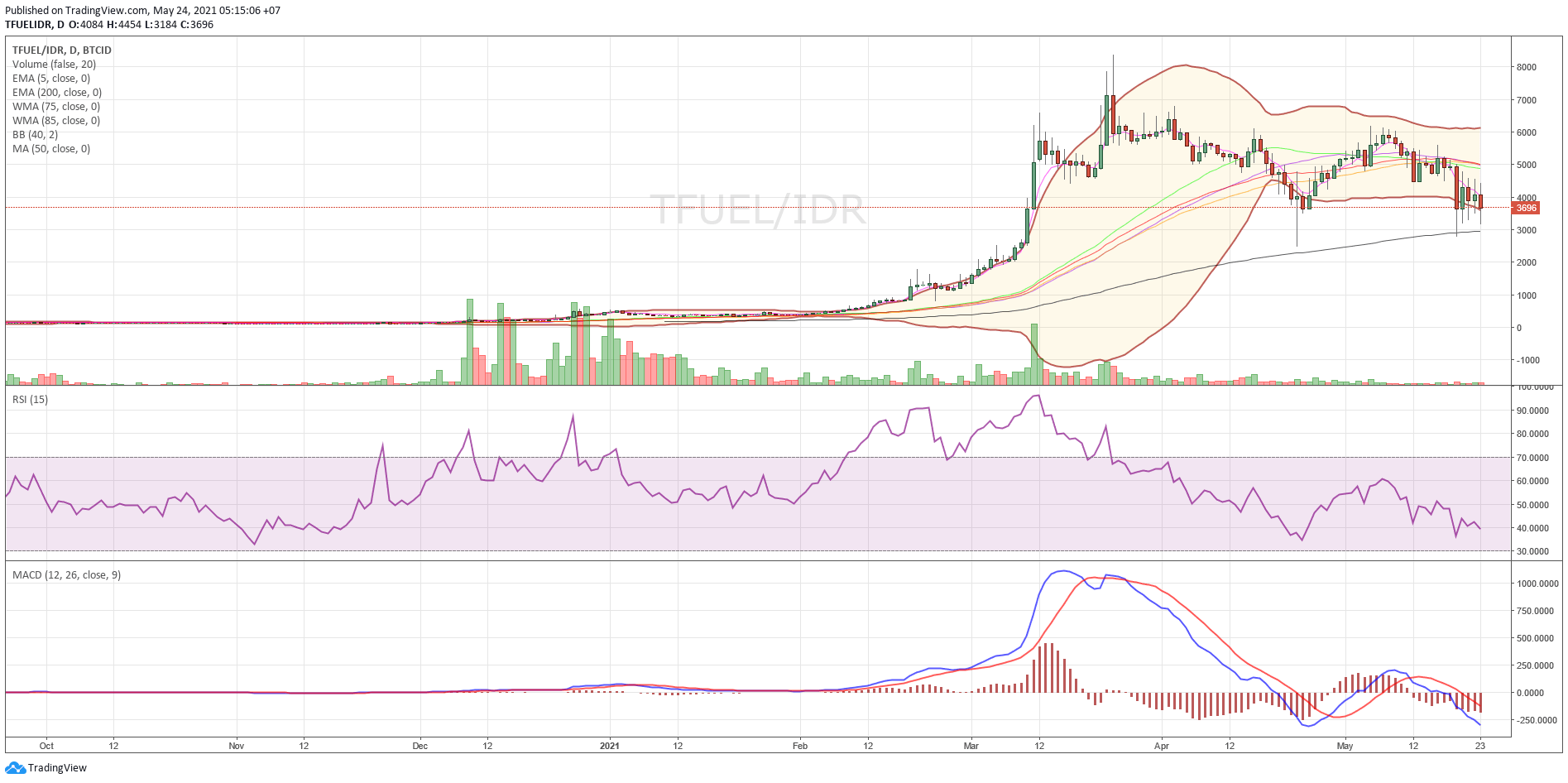

Third, there is the TFUEL crypto asset which will increase this week. Theta Fuel is a utility token of the Theta blockchain platform.

TFUEL is used to support on-chain operations such as payments to relays for sharing video streams, or for deploying or interacting with smart contracts.

Relayers get a TFUEL for each video stream they relay to other users on the network. You can think of Theta Fuel as the “gas” of the protocol.

In today’s trading, the lowest price for TFUEL is IDR 3,184 and the highest is IDR 4,454.

Chart TFUEL/IDR

- Celcius (CEL)

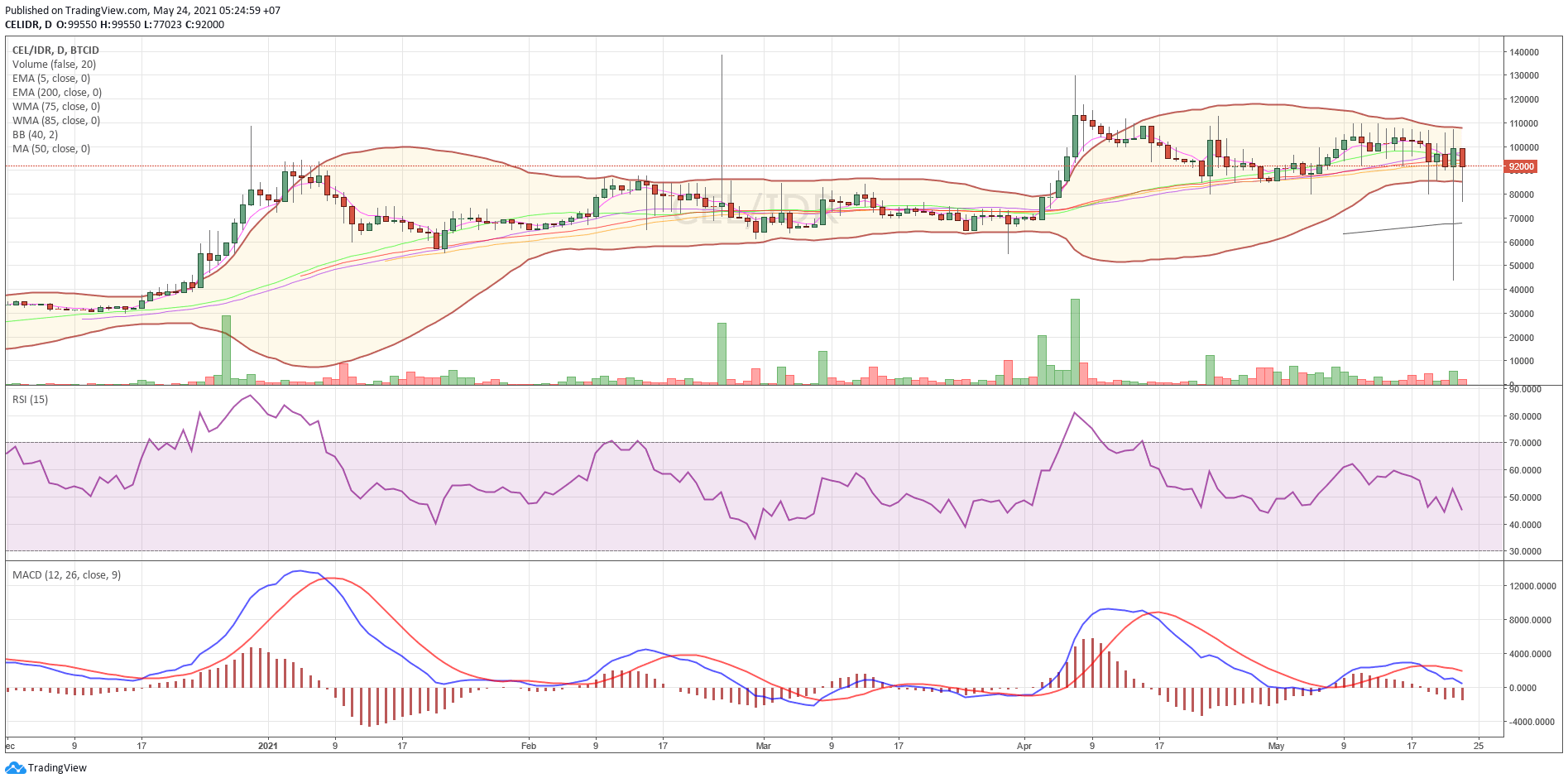

Next, there is Celsius (CEL) which is bullish this week. Celsius (CEL) is an all-in-one banking and financial services platform for cryptocurrency users.

Launched in June 2018, it offers rewards for depositing cryptocurrency, along with services such as loans and wallet-style payments.

Platform users receive regular payments and interest on their holdings. Celsius’ native token, CEL, performs various internal functions, including increasing user payments if used as a payment currency.

Today, the lowest price for CEL is IDR 77,023 and the highest price is IDR 99,849.

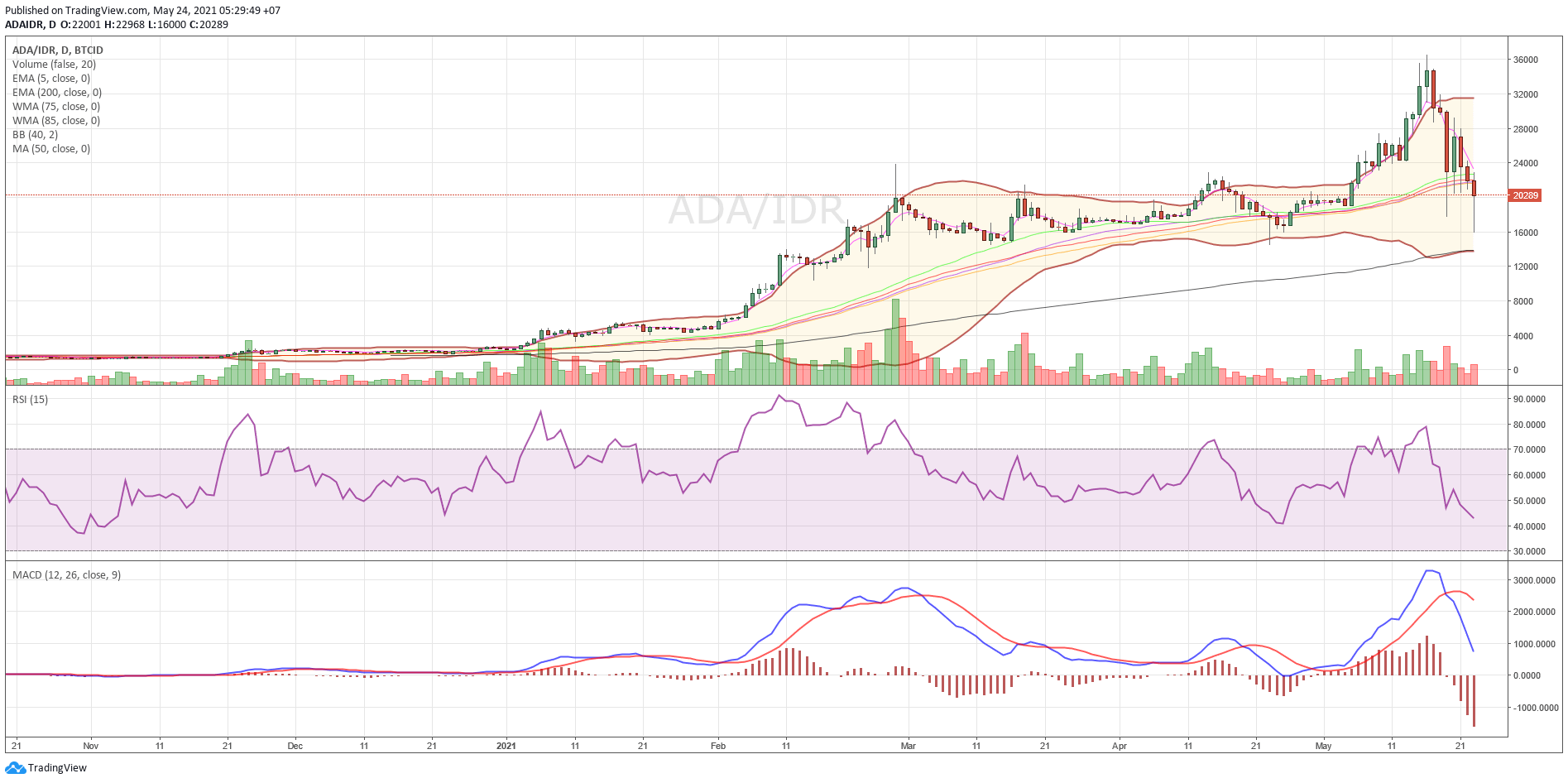

- Cardano (ADA)

Lastly, a bullish crypto asset is Cardano (ADA). This crypto has upgraded its platform a lot. They also stated that they would be ready to play on DeFi and also NFT.

ADA’s price has the potential or most likely to increase this week, after breaking through Rp 35,000, two weeks ago. Although this week, Cardano’s price is lower and has already formed a support

ADA is moving today with the lowest price of Rp. 16,000 and the highest price of Rp. 22,968.

Chart ADA/IDR

5 Crypto Assets will Bearish This Week

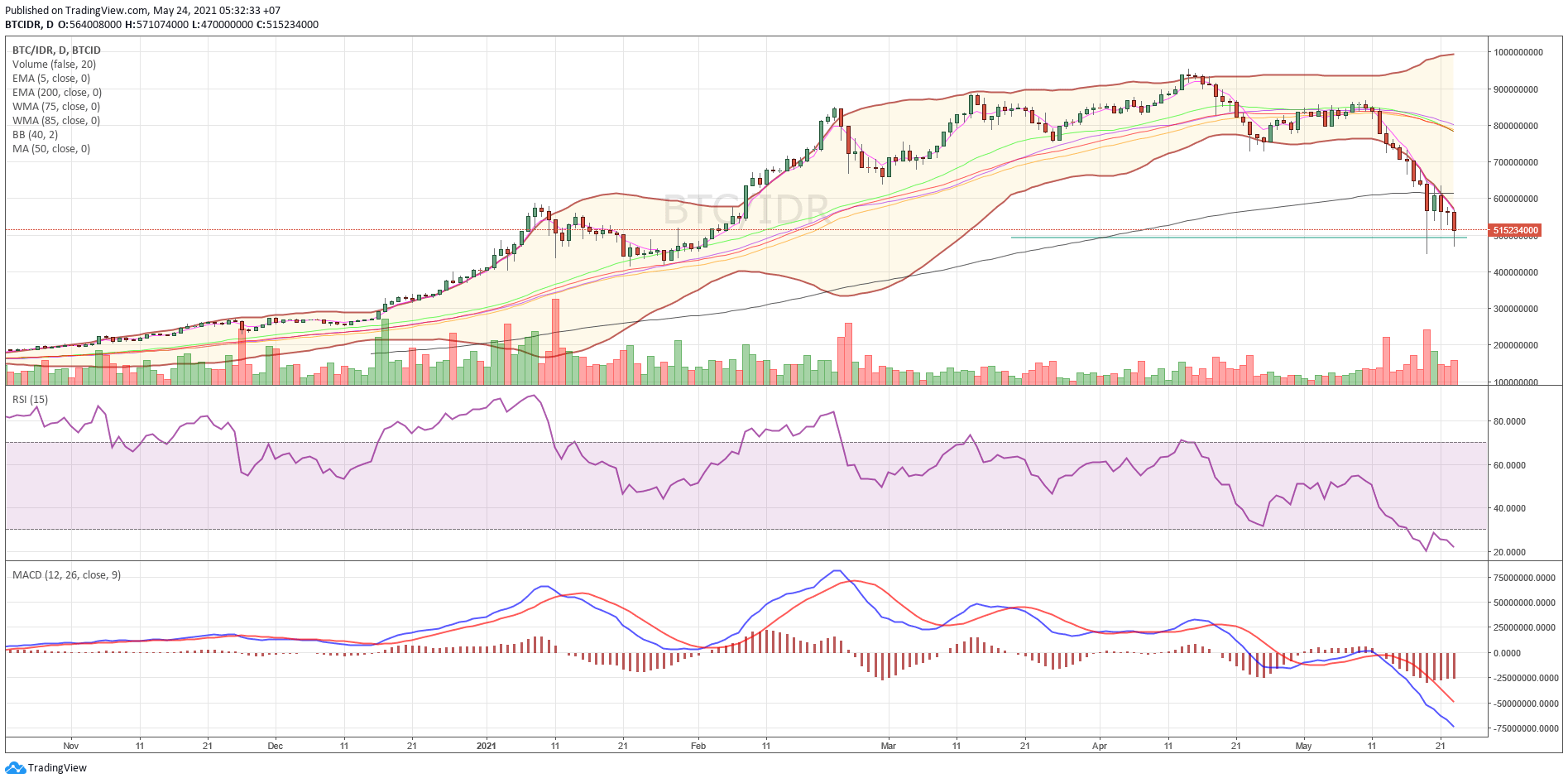

- BItcoin (BTC)

This time, Indodax Market Signal will discuss bearish crypto assets. First, there is Bitcoin which has experienced a drastic decline. Bitcoin has still not been able to experience an increase in price to the highest price of IDR 950 million.

However, it actually decreased. It is not yet certain why BTC has dropped dramatically to a level below IDR 500 million. Although, many media wrote that this was because of Elon Musk’s statement.

Within this week, BTC will still experience a decline in price.

Today, the price of Bitcoin is at the lowest level of IDR470,000,000 and the highest price of IDR571,174,000

Chart BTC/IDR

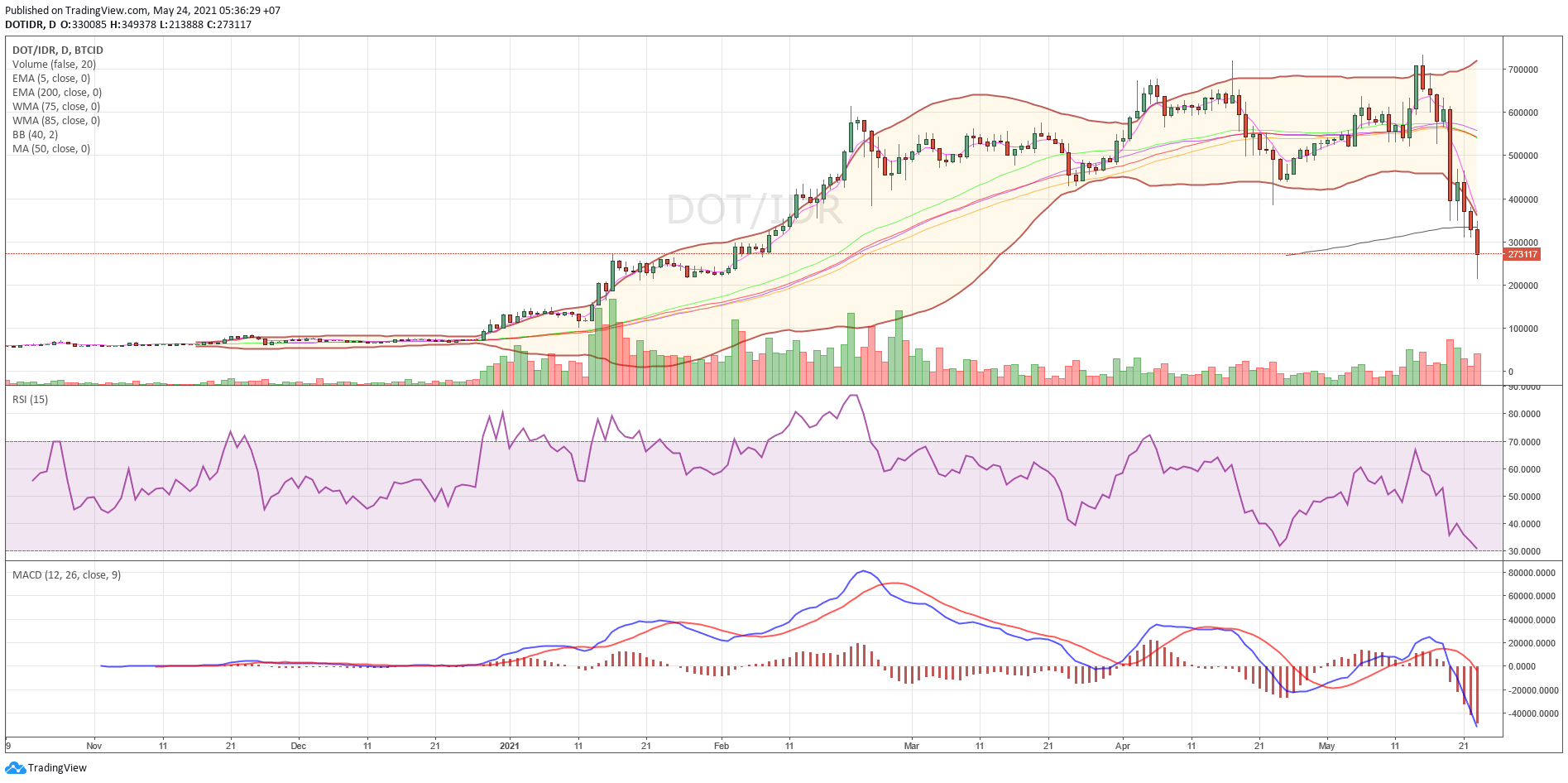

- Polkadot (DOT)

Indodax Market Signal this week also predicts Polkadot (DOT) as a crypto asset that will decline. The DOT seems to be impacted by Bitcoin’s decline.

Polkadot is an open source multichain sharding protocol that facilitates the cross-chain transfer of any data or asset type, not just tokens, thus making the various blockchains interoperable with one another.

Polkadot’s original DOT token had three clear objectives: providing governance and network operations, and creating parachains (parallel chains) by binding.

Today, the DOT is moving with the lowest price of Rp214,888 and the highest price is Rp349,378.

Chart DOT/IDR

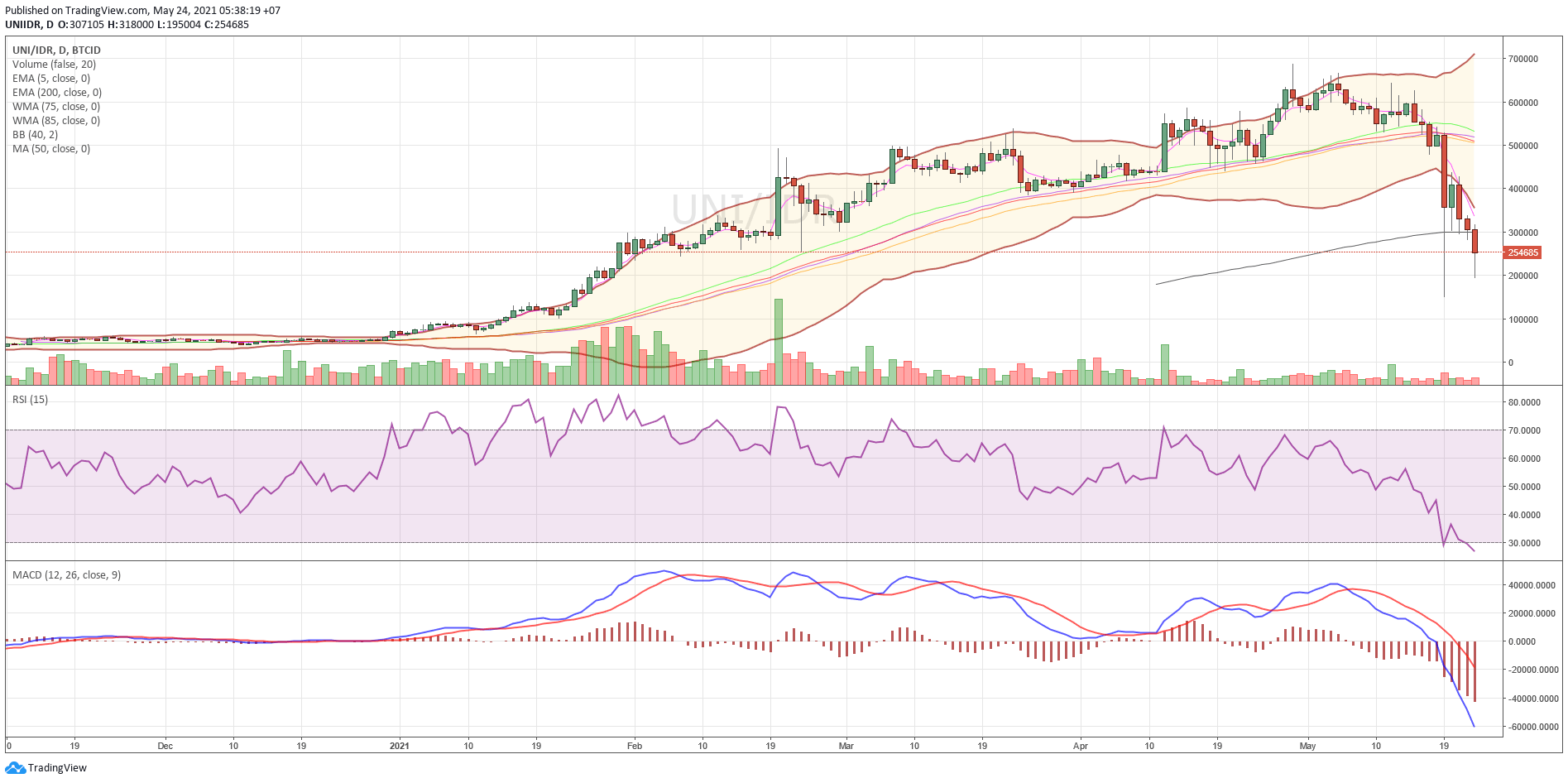

Third, there is Uniswap (UNI) which is a crypto asset from the DeFi platform. Uniswap seems to be outdated by other DeFi platforms such as Chainlink, yEarn.Finance and others.

In fact, Uniswap’s market cap is no longer the highest DeFi platform crypto asset. Chainlink is now higher than Uniswap.

UNI’s lowest price is IDR 195,004 today. Meanwhile, the highest price is IDR 318,000.

Chart UNI/IDR

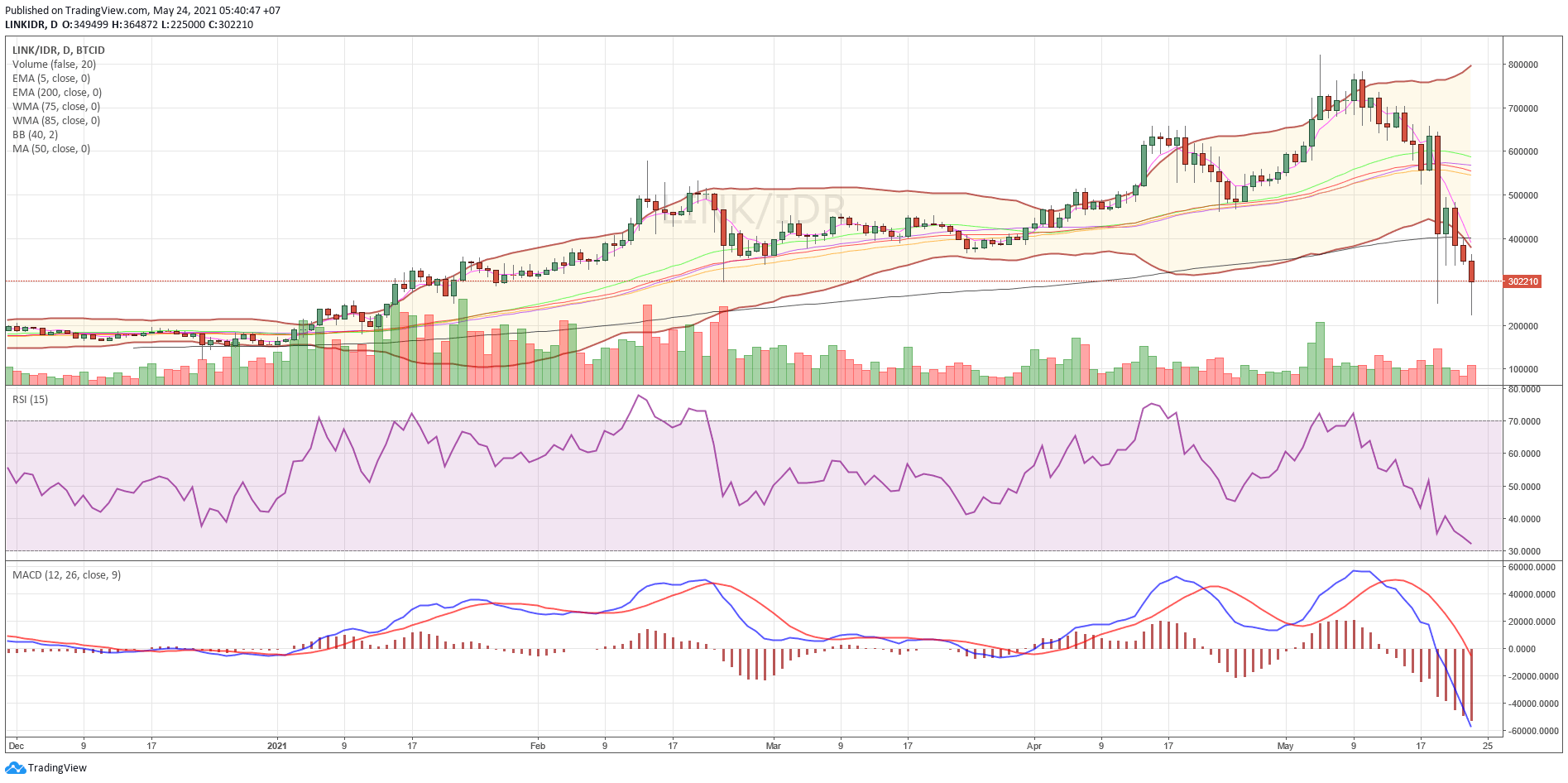

LINK crypto assets may also drop this week. LINK is a crypto asset of the DeFi platform. The decline may have occurred due to the impact of the decline in Bitcoin.

Chainlink is developing a secure blockchain middleware that intends to link smart contracts across the blockchain by allowing smart contracts to access resources outside the main chain such as data feeds, web APIs, and traditional bank account payments.

Today, LINK moved at the lowest level of IDR 225,000 and the highest price of IDR 364,872.

Chart LINK/IDR

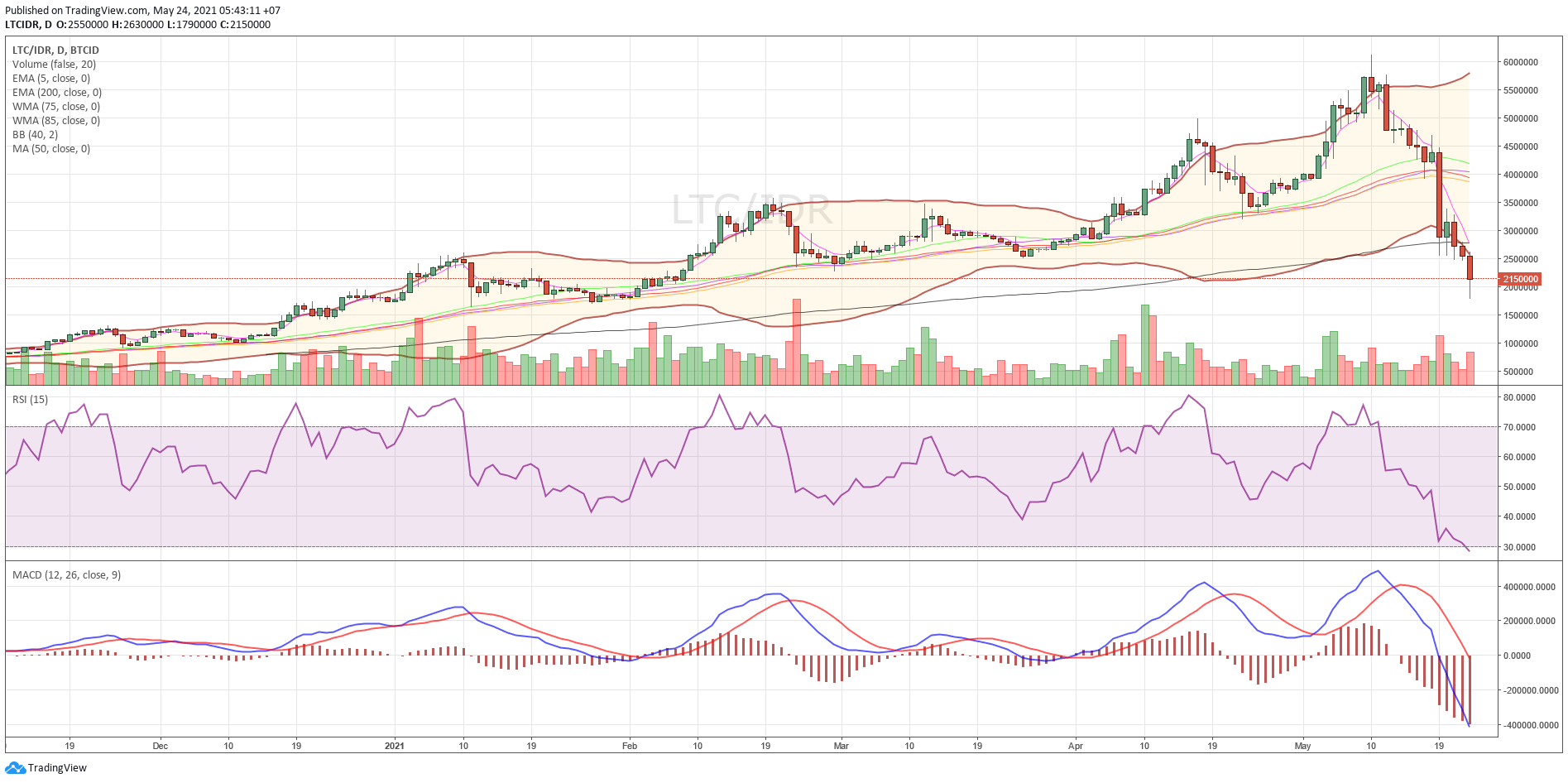

Finally, the crypto asset that is experiencing a decline is Litecoin (LTC). Apparently, this crypto asset was also affected by the drop in the price of Bitcoin. LTC is a crypto asset that adopts proof of work (mining).

Litecoin is a peer-to-peer Internet currency that allows instant payments at almost zero fees to anyone in the world. Litecoin is an open source, fully decentralized global payment network with no central authority.

LTC sold for the lowest Rp1,720,000 in today’s trading. Meanwhile, the highest price reached IDR 2,630,000.

Chart LTC /IDR

NOTE: If EMA 5 crosses the WMA 75, 85 and EMA 200 lines and these lines intersect from bottom to top, the market trend tends to go up (bullish),

In each table above, it shows that if the value of EMA 5 is higher than WMA 75.85 and EMA 200 then the market tends to rise (bullish).

If the RSI and MACD values ??show the same condition, it means that the market is showing the same trend, overbought conditions or oversold conditions are an indicator that the market is at a point of changing the direction of the trend.

ATTENTION: All content which includes text, analysis, predictions, images in the form of graphics and charts, as well as news contained on this website, is only used as trading information only, and does not constitute a suggestion or suggestion to take an action in a transaction whether to buy or sell certain crypto assets. All crypto asset trading decisions are independent decisions by the user. Therefore, all risks arising from it, both profit and loss, are not the responsibility of Indodax.