How to Verify Safely To Avoid Money Laundering

Know Your Customer or KYC is very useful, as AML aka Anti Money Laundering, so that traders can avoid hacking activities to money laundering!

KYC is an important rule set by every financial institution to find out the identity of their customers, where this program is based on Law Number Fifteen Years Two Thousand and Two concerning the Crime of Money Laundering.

Well, one of the steps you can take to avoid Anti Money Laundering or money laundering is to go through the KYC process! This is because the main principle of KYC is to ensure service providers avoid using other parties for money laundering.

The KYC process is carried out by requesting certain information from customers or customers. These efforts are made to ensure that companies and service providers are protected from parties related to crime or terrorism.

Did you know? Indodax also applies KYC steps to every member, you know! This is done by Indodax in order to reduce any risk that could compromise the security of your crypto asset transaction process, such as hacking or other forms of fraud.

Here’s how to do the Know Your Customer (KYC) steps on Indodax:

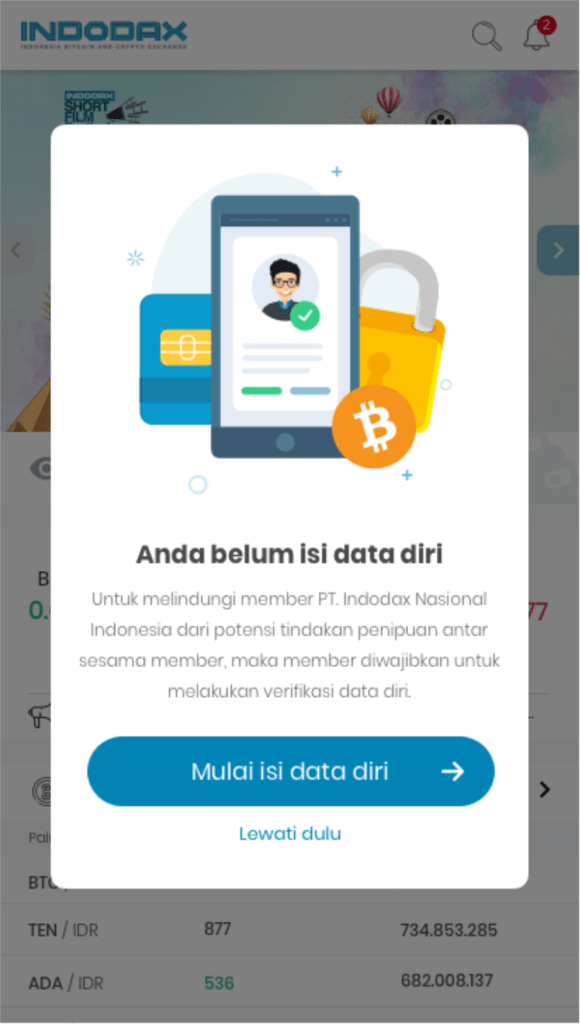

First, after you have successfully registered an account and verified your email at Indodax, you will see this notification to do KYC. Then, you can click “Start Filling in Personal Data”. Currently, KYC on Indodax can only be done through the Indodax mobile application. So, make sure you have downloaded the Indodax mobile application after registering and verifying your email!

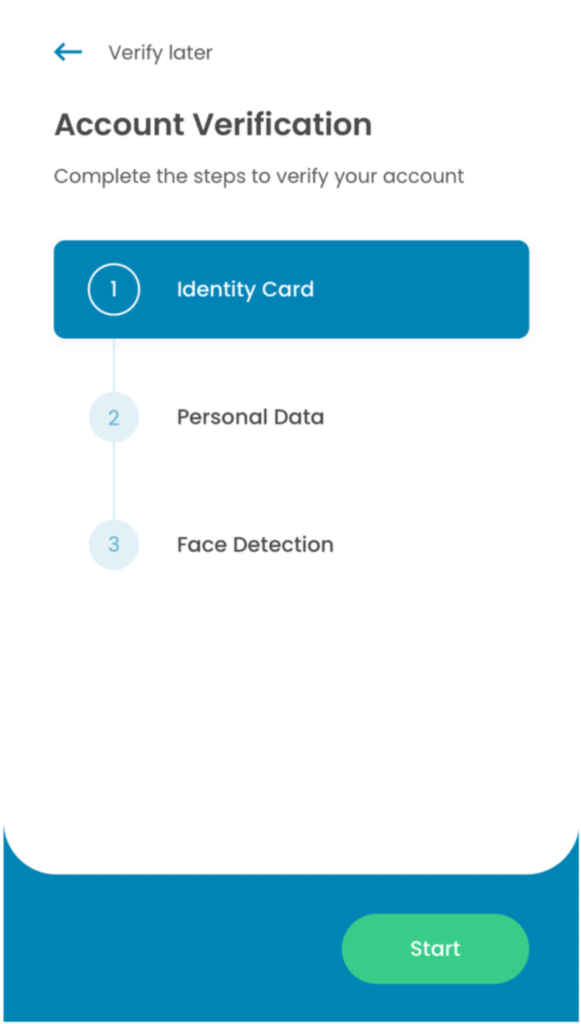

Next, you will see this page, which is the three steps of KYC. If you are ready, you can click Start to get started.

Next, for the e-KTP verification process, enter your country of origin, then click “Take a Photo” for the e-KTP photo. Oh yes, you can only use e-KTP yes! Because, currently, SIM and Passport are not valid for Indonesian Citizens to carry out the KYC process.

However, if you are not an Indonesian citizen, you can use your passport! Because, currently, KITAS or KITAP are not valid for the KYC process. After success, you can click “Finish”.

In the second step, you must fill in all the required personal data. This step is very important! So, make sure all the information about yourself is filled in correctly!

The last step is Face Detection. In this step, make sure the camera on your cellphone is working properly! In order for the Face Detection process to be successful, make sure you don’t use glasses, masks, and have sufficient lighting.

After that, you need to follow the directions to face right and/or left, and the system will record your facial movements for Face Detection!

Well, this process is also very important to do in order to ensure the validity of your account! Oh yes, this face recording only lasts a few seconds, so you have to pay attention to the recording time. Next, if it is successful, then you will see the next page and you only need to click “Done” when all the processes have been completed.

If you have completed the three stages of KYC as above, what you need to do next is agree to the existing Terms and Conditions by clicking the “Agree & Submit” button to complete the KYC process.

If everything has done, all you have to do is wait for the Indodax team to process your KYC verification at the latest once and twenty four hours!

Very simple, right?

So, for Indodax members who haven’t done the Know Your Customer (KYC) process yet, don’t forget to do the KYC process right now, so you can be protected from all events or things that might be detrimental one day!